A Government Subsidy to the Producers of a Product

Based on a required annual report filed with the World Trade Organization the federal government gave farms 95 billion in subsidies tied specifically to the type of product. Government Financial Report of the US.

Effect Of Subsidy In Market Equilibrium Microeconomics

From 2008-09 Central fund under Macro Management Mode of Agriculture Work Plan is used as a matching grant to State fund.

. First the demand curve is a function of the price that the consumer pays out of pocket for a good Pc since this out-of-pocket cost influences consumers consumption decisions. De minimis levels subsidies that fall within small limits. At a Glance Over the past 10 years the federal governments net interest costs have grown by about 25 percent relative to the size of the economy as represented by gross domestic product GDP.

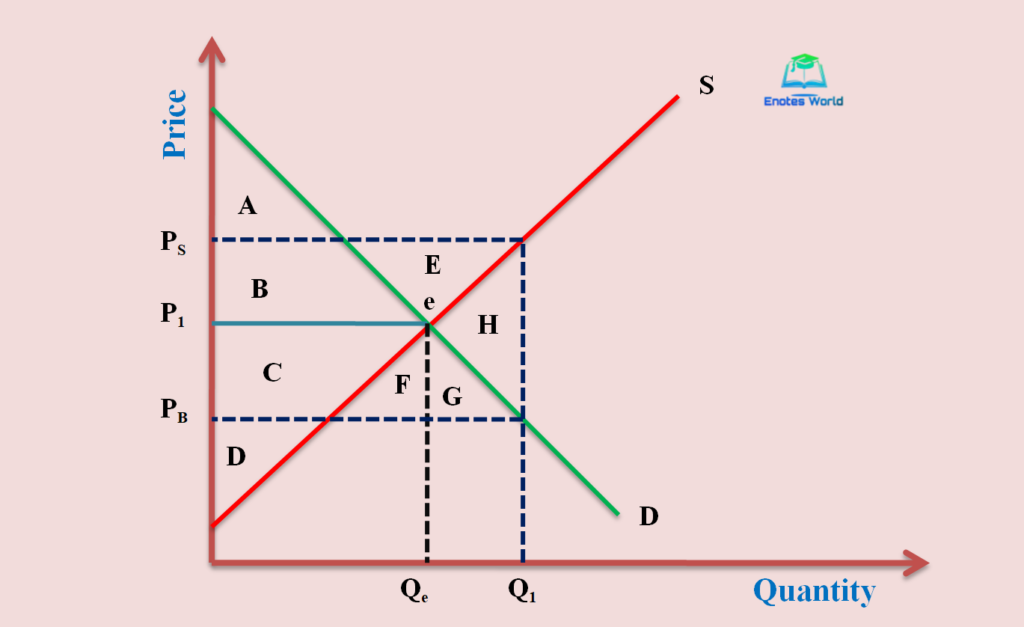

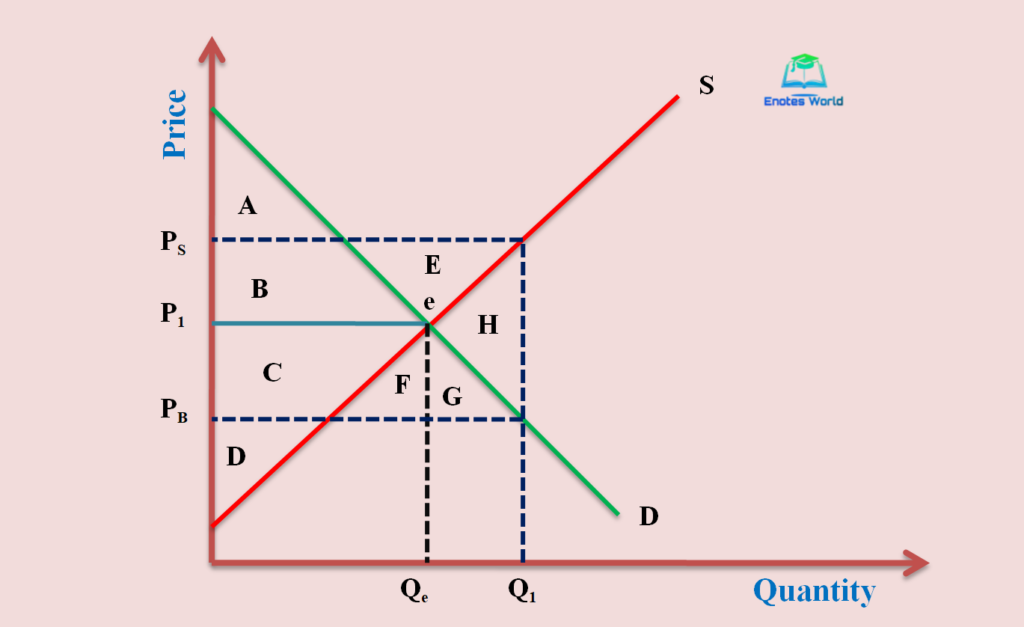

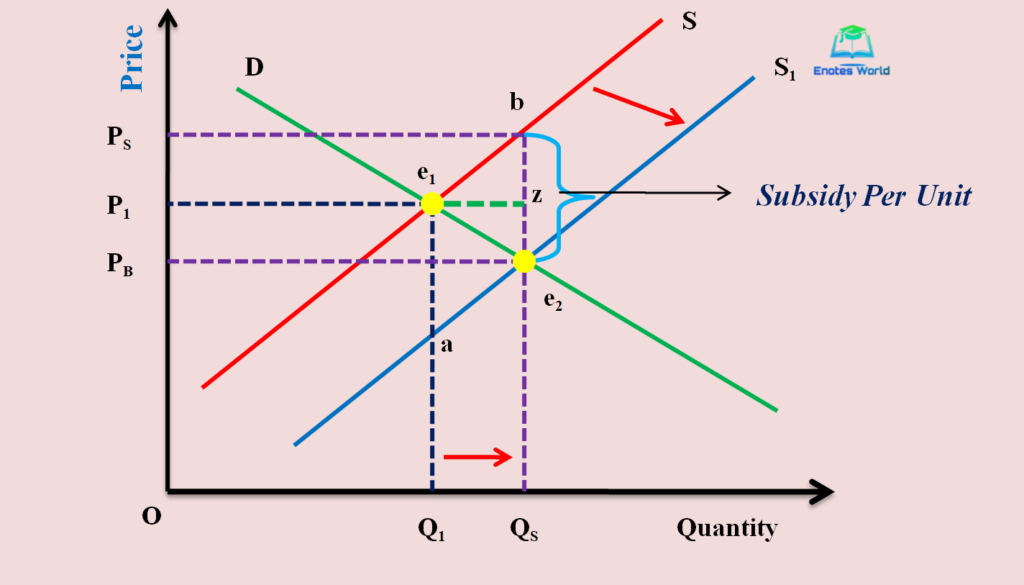

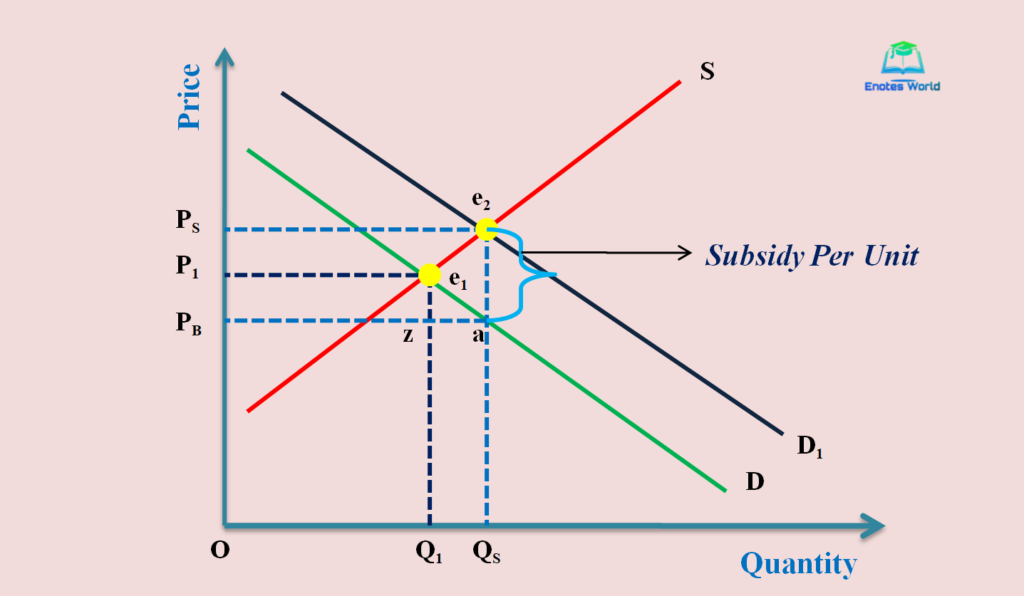

In the product market the government promotes competition by launching antimonopoly deregulation and privatization policies. In the above figure the initial demand curve and supply curve intersect to each other at point e 1This is the pre-subsidy situation with price OP 1 and quantity OQ 1The price receives by sellers and pays by buyers is similar in the pre-subsidy situation OP 1Let us now suppose that a subsidy of e 2 a has granted to the buyers of the product. Governments Support to Farmers Producers Organisation.

Subsidy can protect a firm who need to restructure. For a non-tradable product eg coal the supply cost is the domestic production cost inclusive of any costs to deliver the energy to the. This apart there is a significant subsidy related to the agricultural sector and that is the food subsidy.

Allocate the subsidy always exist fraudulence risk. 75-Year Fiscal Gap Percent of Gross Domestic Product 2 62. Find a crop or livestock insurance agent in your area along with directions to their office.

The economic policy falls into two main categories. This is a percentage of revenues generated from the sale of oil and natural gas products or in some cases takes the product in-kind for the government to sell. Manufacturers to prevent job outsourcing.

Data shows that to be able to clear 75 per cent of the debt of its DISCOMs the Tamil Nadu government will have to shell out 52 per cent of the states GSDP Gross State Domestic Product. The volumes of hydrogen produced will need to meet the proposed UK Low. Congress ended direct payments in the 2014 farm bill except for cotton producers who will continue to get direct payments in 2015 and 2016.

Royalties are just one way oil and natural gas producers contribute to government revenues. Put in place in 2004 this subsidy supported a range of companies by decreasing their effective corporate tax rate. Government response to the consultation _____ 11 Section 2.

Budget of the US. We intend to allow hydrogen producers to receive subsidy for sales of hydrogen to feedstock users and are. Costs for state and local government workers were 2405 at the 10th wage percentile 5213 at the 50th median wage percentile and 9314 at the 90th wage percentile.

Solyndra was a manufacturer of cylindrical panels of copper indium gallium selenide CIGS thin film solar cells based in Fremont CaliforniaHeavily promoted as a leader in the Clean Energy sector for its unusual technology Solyndra was not able to compete with conventional solar panel manufacturers of crystalline silicon. That was only about 44 of the 504 billion in total corn production that year. If the government provides a subsidy.

To reduce the subsidy effect in economic government can adjust the taxation and benefit system. Historically low interest rates have held down that growth compared with growth in debt held by the public. Employer Costs for Employee Compensation ECEC a product of the National Compensation Survey provides the average employer cost for wages and salaries as well as.

Well be reporting on ARC payments in the next farm subsidy database update. Corn growers received the most product-specific assistance with 22 billion in subsidies. Jodi Beggs To find the market equilibrium when a subsidy is put in place a couple of things must be kept in mind.

For instance if a domestic company sells a product for 10 while its international competitor sells the same for. There is a general willingness to look at de minimis levels for developing countries and possibly. Second the supply curve is a function of the price that the producer.

The twin policy of providing market support to the food grains producers and supplying at least a part of the requirement to consumers at reasonable prices along with the policy of keeping a buffer- stock of required quantity for national food security. In exchange for the right to develop these resources companies pay the government a royalty. But they have evolved to become very complex.

The new farm bill also authorized a new farm subsidy called Agriculture Risk Coverage ARC that doesnt go into effect until 2015. Rationale for a production-focused business model and key design parameters _ 11. The government has launched a new dedicated Central Sector Scheme titled Formation and Promotion of Farmer Producer Organizations FPOs with a clear strategy and committed resources to form and promote 10000 new FPOs to ensure economies of scale for farmers over the next five years.

Fossil fuel subsidy removal would also reduce energy security concerns related to volatile fossil fuel supplies. The FCIC promotes the economic stability of agriculture through a sound system of crop insurance. Explicit subsidies occur when the retail price is below a fuels supply cost.

Over the same period that debt has increased by nearly 65 percent relative. Farm subsidies are government financial benefits paid to the agriculture industry that help reduce the risk farmers endure from the weather commodities brokers and disruptions in demand. Competition forces producers to be more efficient and innovative to stay in the market and make a profit.

A 2116 billion decrease in SBA net costs largely driven by a 2300 billion decrease in loan subsidy costs including reestimates attributable to the PPP and Debt Relief programs under the CARES Act. A subsidy by government offered to businesses enables them to keep prices of certain products lenient so that people can afford them. Wherein the producers can.

From 2003-04 as per the State Government announcement the rate of subsidy was increased to 50 per cent with the State share of 25 per cent in addition to the Central share of 25 per cent. So the firm will not work hardly because they government subsidy will become a part of profit of them. As a result only large producers can take advantage of farm subsidies.

While this deduction was available to domestic manufacturers it nevertheless benefitted fossil fuel companies by allowing oil producers to claim a tax break intended for US. Opinions also differed on whether commitments to reduce Amber Box subsidies should be disaggregated according to product or stay at total AMS aggregate measurement of support. About two years after the Obama administration co.

Effect Of Subsidy In Market Equilibrium Microeconomics

No comments for "A Government Subsidy to the Producers of a Product"

Post a Comment